There is obviously quite a bit going on both locally and globally in this last full week of February that has our focus. We have been talking to all our clients constantly about risk in the market – about how risk is always there to some degree in life and in investing and how important it is that your portfolio matches your goals. We understand how easy it may be to get caught up in news stories and to think the whole market is going to fall apart. And certainly, days like these make the worst-case scenarios seem more possible than we would ever like.

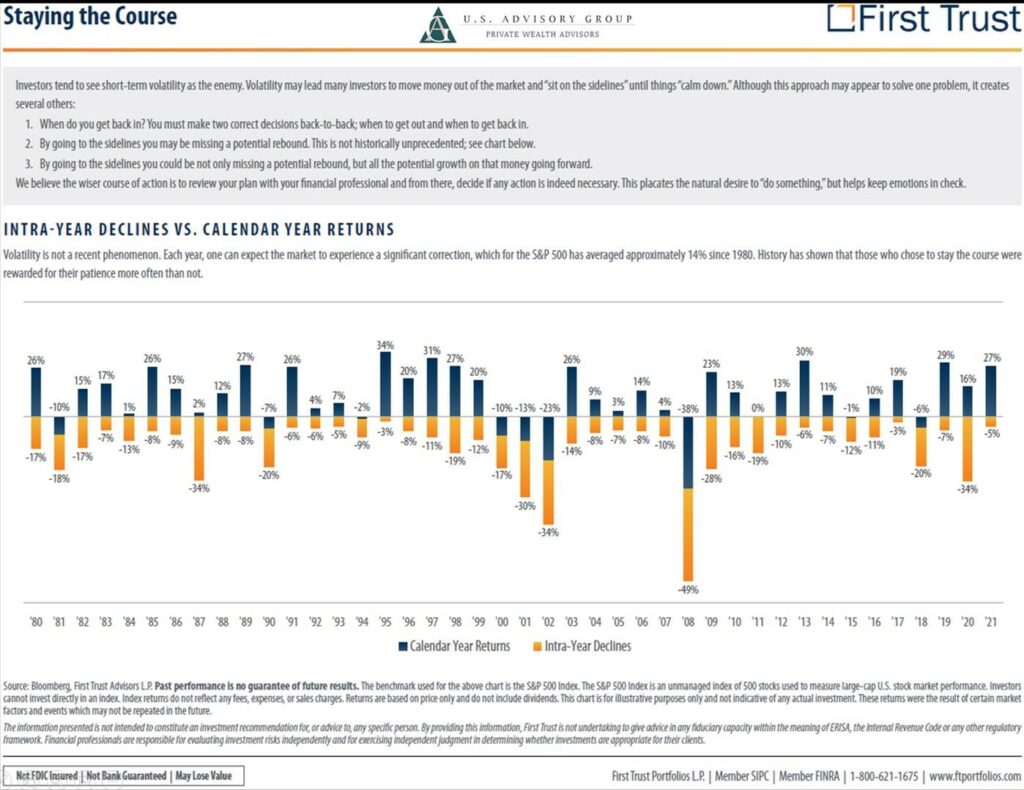

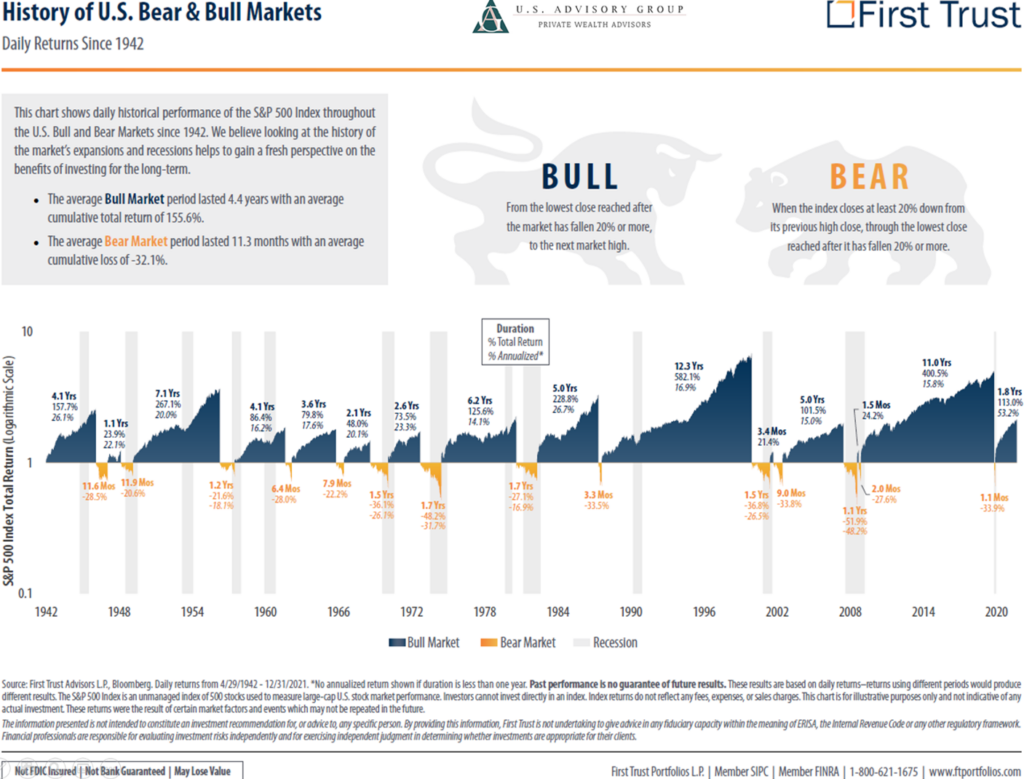

We could go on to discuss inflation or energy prices but on days like these it’s also important to zoom out. The markets will get through this, and you will too. We have been steadily & consistently adjusting not only the allocation of your portfolios but your overall strategy where necessary to best combat these risks in the market. If you have a longer time horizon, these market corrections historically are absorbed into longer term overall performance. If you have a shorter time horizon, we have already considered the level of risk appropriate for you and the best ways to protect your principle to be successful in the coming years. This is why we have diverse portfolios and why we often use several accounts in order to build a sustainable plan.

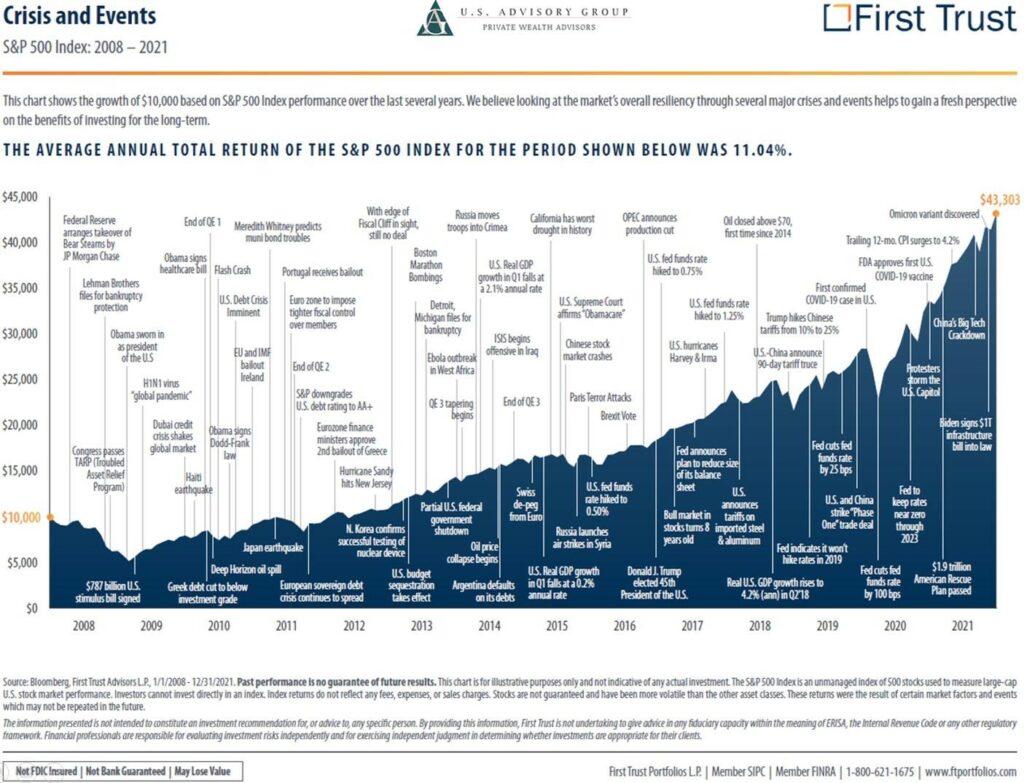

There are three slides attached below which show the importance of staying the course through these difficult times. We anticipate making future allocation adjustments to continue to be best positioned with the information we have, but ultimately, we feel there is plenty of sound reasoning to remain invested.

We are here watching your portfolios; consuming analysis and listening to experts to best provide you with financial advice and solutions for your financial plans. Please do not hesitate to reach out if you have any questions or concerns and we will be happy to assist.

Thank you for your continued confidence and trust.