Happy New Year from US Advisory Group! With the kickoff of 2024, we want to use this opportunity to share our thoughts and perspectives on a rollicking 2023 and what we are seeing as we look ahead into 2024. This 3-page, relatively brief and high-level, newsletter includes:

- What’s New at the US Advisory Group Offices & What’s Ahead in 2024

- A Macro-Economic Overview

- Investment Insights and Planning Strategies for the New Year

What’s New at USAG

After a very busy 2022 migrating onto our new platform at LPL Financial, one of our main goals of 2023 was ensuring our clients and systems were introduced to and enhanced by the new capabilities on the platform. Virtually 100% of our clients now have access to Account View where clients can see real time data of all their accounts they have with US Advisory Group through a single log in.

Furthermore, we’ve gotten back to our roots with Financial Planning to complement Investment Management. Our new Goal Planning Tool is much more user-friendly than our previous software, and clients can easily enter additional financial data for accounts held elsewhere in order to accurately track their progress towards their goals, which we think is great!

We also added a number of new clients and families to the firm in 2023, almost entirely due to referrals from our trusted partners in the legal & accounting fields, as well as through our clients & friends – Chris & I want to stress how much we appreciate a referral, as there’s nothing that quite says our work is appreciated by connecting people who trust your advice and opinions to our practice – we can’t say it enough – THANK YOU!!!

Geographically, most of our clients continue to live on the North Shore, but due to folks’ continuing comfort with virtual appointments, we have added to the list of folks on the Cape and across the country (we see you down there in St. Croix!). All the states that we are registered to offer financial advice in are listed in our firm’s compliance documents. Please don’t hesitate to ask us if you would like more information about connecting with friends & family outside the North Shore.

In addition to the investment portfolios that we manage and tend to spend the most time in meetings talking about with clients, there are other financial tools and services that have come up recently in client meetings. We have been busy helping people with educational accounts (529s) and conducting Life Insurance analyses for growing families. Many people have asked us about cash alternatives for those seeking some yield with minimal risk. We have short-term cash management tools here that have become quite popular and we’re happy to help in that space as well. These tools are all part of our array of options for helping you protect your assets and build towards your future goals.

We have continued our normal schedule of quarterly/semi-annual/annual Client meetings, and we expect to get back to offering clients the opportunity to hear directly from some of the most intelligent portfolio managers in the world. While generally those will be virtual events (and we know how much people love sitting in front of their computers…), we have found that clients who have attended those events have found them to be immensely valuable and informative, and we will be opening those up to our Clients friends & families in 2024 as well – please feel free to invite folks you think might benefit from these Investment Insights!

Look also for future in-person events, likely to kick off after Tax Time, as an opportunity for us to get together over a cold beverage, relax, and talk about some of the economic and/or investment scenarios we discuss here in the office on a regular basis. In the meantime, our doors and phones are always open during regular hours for drop-ins and to help with anything that comes up.

Macro-Economic Thoughts from USAG

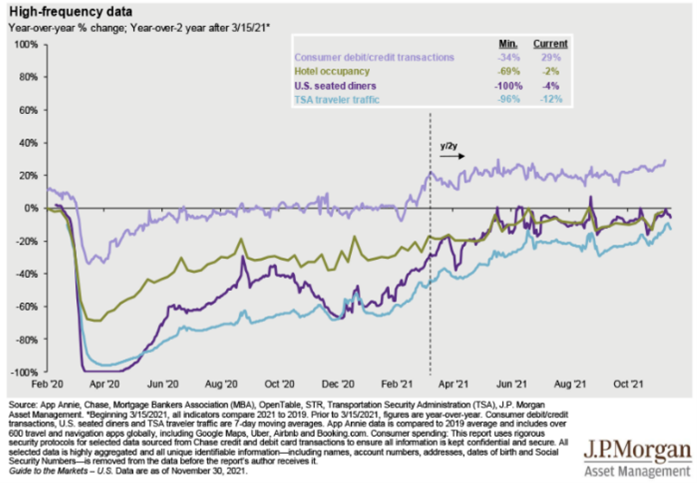

Speaking of economic scenarios… 2023 was a turbulent year in the global economy but by and large, it was a positive year for growth. Many indicators would have led you to believe otherwise, such as geopolitical challenges in Ukraine & the Middle East, the global struggle to normalize interest rates post-COVID, and adapting to a new normal in commercial real estate markets but through it all, staying invested and blocking out emotion led to some pleasant, if not surprising, investment results over the past 12 months.

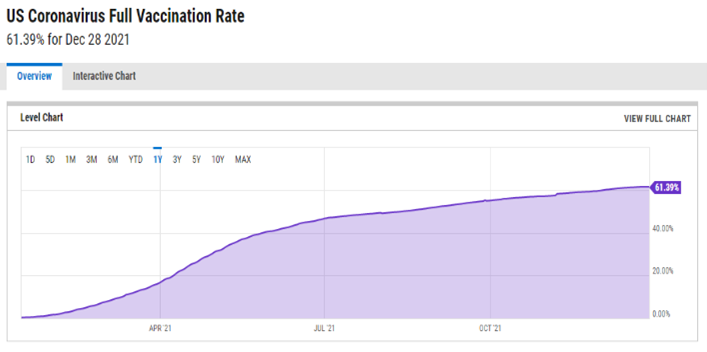

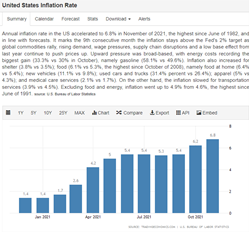

The US has done relatively well compared to other developed global economies by GDP but still has massive debt from the influx of COVID dollars that future generations will be repaying. Many people in our country have never experienced inflation quite like what we saw in the earlier part of 2023, and we know how burdensome that can be on your budgets and spending. Fortunately, inflation is cooling now, and prices are beginning to normalize.

Looking ahead, we are sailing into (another!) Election Year with the Iowa Caucuses around the corner and New Hampshire’s primary on Jan 23rd. We expect the already elevated political rhetoric to continue to spike, and while that may be a major cause of jitters at home, we don’t expect that to drive major economic swings in 2024.

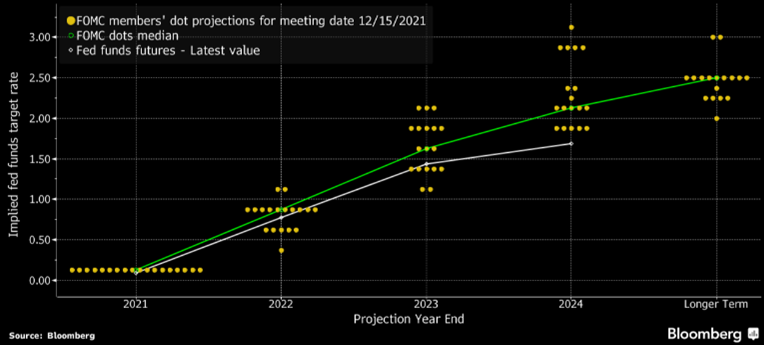

What will continue to be of more consequence is the handling of inflation and interest rates. The Fed has signaled it is done with raising rates in the short term, and whether that is actually accurate, rates stabilizing in the back end of 2023 helped boost a rebound of many sectors of the domestic economy in the 4th Quarter.

Investment Insights and Planning Strategies

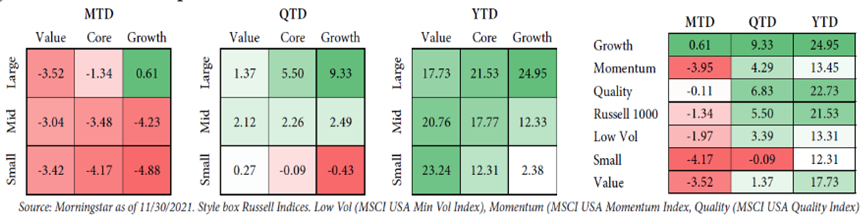

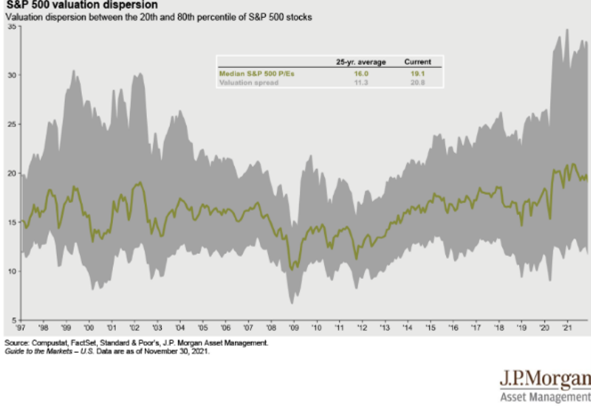

What did the investor experience look like in 2023? For much of the year, there was a major disparity in US Large Cap equities – typically the engine of peoples’ equity portfolios – between “the market” and “The Magnificent Seven.” We talked often about who those companies are and how they took a hold of the indexes with huge years in 2023. The Magnificent Seven consists of Amazon, Apple, Alphabet (Google), Meta (Facebook), Microsoft, Nvidia and Tesla, all tech companies, and companies we would typically see struggle in a high interest rate environment.

Indeed, Nvidia and Meta were the top two performers in the S&P 500 index in 2023 with Tesla and Amazon both in the top 20 as well. All these companies have been leaders in the Artificial Intelligence boom and successfully beat concerns that high interest rates would stymie growth stocks.

We liked some of these large cap growth companies in 2023, but with rates high and the likelihood for growth muddled by the various concerning factors mentioned above, we generally favored a more risk-off approach on our equity portfolios. While we had some exposure to these tech companies through a variety of thematic and/or indexed ETFs, the core of our equity positions remained in the Dividend Growth and Value spaces, which generated steady income and less risk, but underperformed pure growth strategies.

With interest rates holding steady or possibly/likely declining in 2024, we can expect more room for the growth companies to run. But we think value stocks, by nature, are due for a bounce as well. And not to be forgotten, fixed income investing presents an opportunity for more growth than we have seen in almost a decade. Bonds are generating a higher percentage of yield than we have seen in years, and with the potential for interest rate cuts to boost bonds’ underlying value, there’s opportunity here that we are excited about, particularly to assist our more conservative portfolio models. We have also and will continue to add duration to our fixed income positions, not by leaps and bounds, but conservatively moving out a bit away from short-term positions into bond portfolios with slightly longer durations.

As for specific strategies, 2023 saw an introduction to the use of buffered strategies inside many of our models to hedge equity risk and that should continue into 2024, and we also remain believers in institutional real estate (staying clear of office and retail) as a further alternative to equity and fixed income investments.

On the planning front, we are working to prepare our clients for the Sunsetting of the Tax Cuts & Jobs Act provisions in 2025 that will impact estate tax thresholds on the federal level and may have trickle down effects on some of the financial planning tools we use to help protect clients and families when it comes to taxes and asset protection – we will be discussing this on a client-by-client basis in 2024!

In closing, we would like to wish all of you a wonderful, prosperous, and healthy 2024 – we look forward to a great year ahead full of opportunity and joy, and we thank you from the bottom of our hearts for your trust in helping you and your families navigating a successful path to your financial well-being!

Yours sincerely,

Tucker McDonald Chris McDonald

President CEO

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing includes risks, including fluctuating prices and loss of principal.